Newly Released Wine Data from Tmall

Write | WBO Morris Translate and Edit | WBO Kiwi

Recently, “2017 Tmall Drinks Online Consumption Data Report” has released.

This report was edited and released by Tmall and CBNData, and the figures came from Alibaba's big data base.

The report provided a special chapter of detailed analysis for wine only, which other kinds of drinks don’t have. WBO believes that there are some data worth analyzing and learning from.

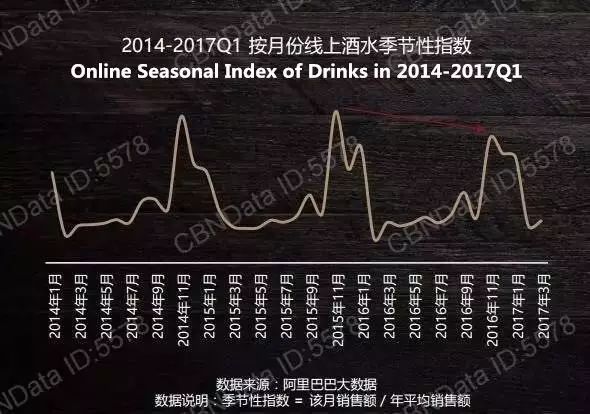

As the report shows, online seasonal fluctuations in wine and spirits sales is still obvious from 2014 to the first quarter of 2017, from September to next January is the peak season. Although online consumption is considered to be dominated by personal purchase, its peak and off season seems the same as traditional channels.

Photo credit:Alibaba

Seasonal index= sales value of the month/ average annual sales value

But among all channels, online sales of wine accounted for almost the same amount among four seasons, and its sales usually rank the second among all quarters.

In autumn and winter, wine peak season of the year, Chinese liquor accounted for more than 50%, while wine sales in autumn accounted for the lowest of the year. This shows that in online channel, Chinese liquor affected more severely by the peak and off season, far beyond wine.

A distributor said, “wine is now entering into young people's daily life. People drink wine at dinner or before sleep, but few people drink Chinese liquor before going to bed. This is the main reason for wine peak and off season not as obvious as that in Chinese liquor.”

Changyu is the chasing-after domestic wine brand in online channel

China wine producing giant Changyu appeared in the data report for many times. Changyu is the only domestic brand that has been ranked into the Top5 of frequently purchased wine brands online.

Photo credit:Alibaba

According to WBO, orders of a single item under Changyu have exceeded Chinese liquor and beer in 2016, and ranked first then.

The report also revealed, domestic wine online share gradually increased in recent years. At present, domestic wine accounted for 19% of the total wine sales value.

Domestic wines have developed and performed well in these years, so they began to grab the market share, according to WBO Observation. That’s why sales value of New World and Old World wines is shrinking gradually.

The report also showed, domestic wines that Tmall sold are from three major producing regions: Wuwei in Gansu province, Tonghua in Jilin province and Huaizhuo basin in Hebei province.

As data showed, from 2015 to 2016, growth rate of wine sales in Tmall is lower than average annual growth of overall drinks. In other words, wine has entered a period of relative modest growth, and wine consumption base has become larger than before.

According to WBO analysis, if online consumption can break through the fourth or fifth tier cities, maybe a new period of high-speed growth is on the way. In addition, for Tmall itself, current focus points should be in structural change in wine sector, level improvement and consumer base increasing.

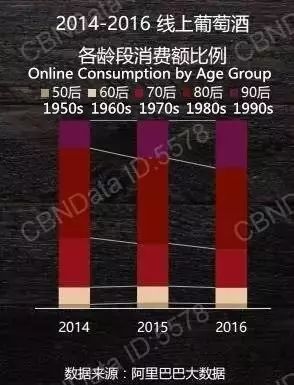

From the consumer age analysis in Tmall wine sales, consumers born in 1970s and 1980s are still the mainstream, but consumers born in 1990s are also in the rapid rise, and have now surpassed those born in 1970s at the current sales value. It seems future wine market should and will be placed more in younger generation.

Photo credit:Alibaba

Britain and Liechtenstein have entered Top10

Wine sales ranking in Tmall looks different from offline channel by countries. The Top2 countries are in line with the offline, but in terms of the third position, it’s Chile in offline channel and Spain in online. This shows that Spanish wines are popular online because of their price advantage and single item boom.

Among the Top10 countries in Tmall data, Britain and Liechtenstein were unexpected. These two countries are not the main wine producing countries in the world. Liechtenstein produces some white wine, which is a non- mainstream wine in the China market. WBO analyzed, Tmall's large business partners are from these two countries, that is the core reason.

However, WBO searched in Tmall official website for wines produced in Liechtenstein and found nothing as a result.

Table credit:Custom and Alibaba